The Ultimate Service: Independent Adjuster Firms for Insurance Claims Monitoring

The Ultimate Service: Independent Adjuster Firms for Insurance Claims Monitoring

Blog Article

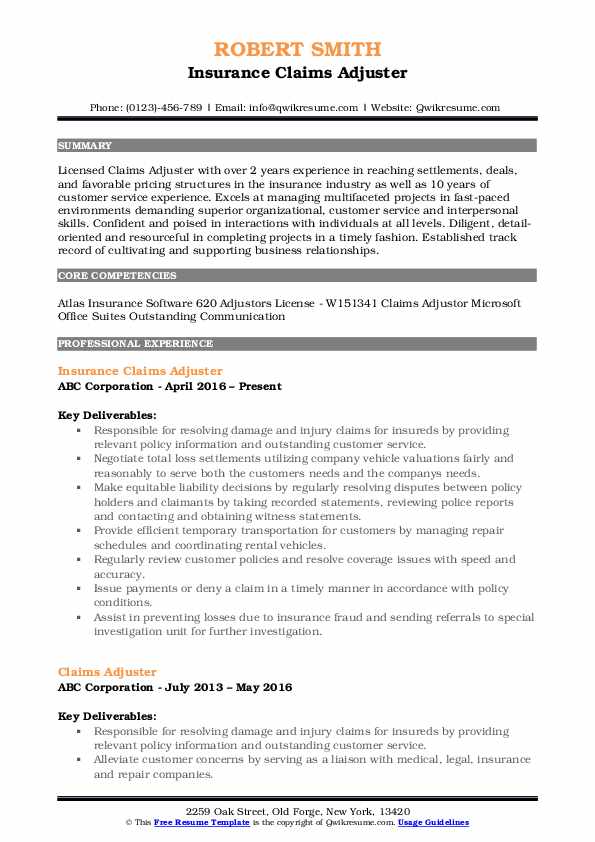

Opening the Keys to Success as an Independent Adjuster in Insurance Policy

In the detailed world of insurance coverage cases, independent insurers play a vital duty in making certain reliable and fair negotiations for all celebrations involved. As specialists navigating the intricacies of this field, there exist certain nuanced strategies and strategies that can considerably influence one's success in this role. From understanding the art of customer communication to honing arrangement abilities and embracing technological developments, the path to coming to be a top-tier independent insurer is led with deliberate activities and continuous knowing. These are merely the surface area of the iceberg when it comes to unraveling the tricks that underpin real success in this demanding yet gratifying occupation.

Mastering Client Interaction

Mastering client communication is a crucial ability for independent insurance adjusters in the insurance coverage market to properly develop count on and deal with insurance claims efficiently. Clear and succinct communication is type in guaranteeing that customers recognize the claims procedure, really feel sustained, and have self-confidence in the insurance adjuster's capabilities. By actively listening to clients' issues, giving routine updates, and describing complex insurance policy terms in a simple way, insurance adjusters can develop a strong connection with customers.

Negotiation Skills Development

Developing reliable negotiation abilities is crucial for independent adjusters in the insurance coverage sector to successfully solve insurance claims and reach mutually valuable agreements with stakeholders. Arrangement abilities surpass just choosing a buck amount; they incorporate the ability to pay attention actively, recognize numerous viewpoints, and work together to find remedies that please all celebrations entailed. Independent insurance adjusters need to be adept at evaluating the value of a claim, promoting for reasonable negotiations, and building connection with clients, insurance policy holders, and various other professionals in the market.

To improve their arrangement abilities, independent insurance adjusters can benefit from continuous training, workshops, and mentorship programs that concentrate on dispute resolution, communication techniques, and tactical negotiating. Practicing situations and engaging in role-playing workouts can assist insurance adjusters improve their strategies and become a lot more comfy navigating difficult conversations. Furthermore, remaining informed regarding sector fads, regulations, and finest practices can give insurers with important insights to utilize during negotiations.

Leveraging Innovation for Performance

To enhance their claims processing and boost their productivity, independent insurance adjusters can harness the power of technical tools and platforms for improved performance in their day-to-day operations. By integrating innovation right into their operations, insurance adjusters can expedite the cases dealing with procedure, reduce hand-operated mistakes, and supply even more accurate evaluations.

One trick technical tool that independent insurance adjusters can utilize is cases administration software program. This software allows insurers to organize and track claims, communicate with stakeholders, and generate reports extra effectively - independent adjuster firms. In addition, making use of mobile applications can make it possible for insurers to capture real-time data, gain access to info on-the-go, and improve communication with colleagues and customers

In addition, expert system (AI) and device understanding innovations can aid insurers in analyzing data, determining patterns, and making data-driven choices. These modern technologies can enhance the insurance claims examination process, enhance accuracy in approximating problems, and inevitably cause quicker claim resolutions.

Structure Solid Industry Relationships

Developing strong links within the insurance coverage sector is vital for independent insurance adjusters seeking lasting success and development in their profession. Structure strong industry connections can open doors to brand-new chances, boost your track record, and provide valuable resources to master the field (independent adjuster firms). One key aspect of cultivating these links is maintaining open and clear communication with insurance coverage business, fellow insurance adjusters, professionals, and other industry specialists

Networking occasions, meetings, and online systems can offer as important tools to get in touch with people in the insurance policy sector. Attending these celebrations not just enables for the exchange of concepts and finest practices but also aids in constructing trust and integrity within the community. Moreover, actively taking part in market organizations and teams can additionally strengthen your visibility and online reputation as a reputable independent adjuster.

Continuous Specialist Advancement

Embracing a dedication to recurring discovering and ability improvement is vital for independent insurers intending to prosper in the vibrant landscape of the insurance policy market. Continual specialist development makes certain that adjusters stay abreast of sector patterns, guidelines, and best practices, which are vital for supplying high-grade services to clients.

To achieve success in this field, have a peek at this site independent insurance adjusters have to take part in different kinds of continual understanding. This can include going to industry meetings, signing up in pertinent training programs, acquiring qualifications, and proactively seeking responses from advisors and anonymous peers. By continuously fine-tuning their understanding and skills, adjusters can adapt to the advancing demands of insurer and insurance policy holders, ultimately boosting their reliability and bankability in the sector.

In addition, staying existing with technical developments in the insurance market is vital. Independent insurance adjusters need to spend time in discovering just how to take advantage of brand-new tools and software to streamline their procedures, improve effectiveness, and deliver even more exact assessments. Accepting continuous specialist growth not only benefits the adjusters themselves however additionally adds to the general development and success of the insurance policy market as a whole.

Final Thought

To conclude, success as an independent adjuster in insurance coverage calls for grasping customer communication, establishing negotiation abilities, leveraging innovation for performance, building strong market partnerships, and engaging in continuous expert growth. By honing these vital locations, insurance adjusters can boost their performance, boost their credibility, and inevitably attain long-lasting success in the insurance sector.

Developing solid connections within the insurance sector is vital for independent insurers looking for long-lasting success and development in their career. Actively taking part in industry associations and groups can even more strengthen your visibility and credibility as a reputable independent insurer.

Report this page